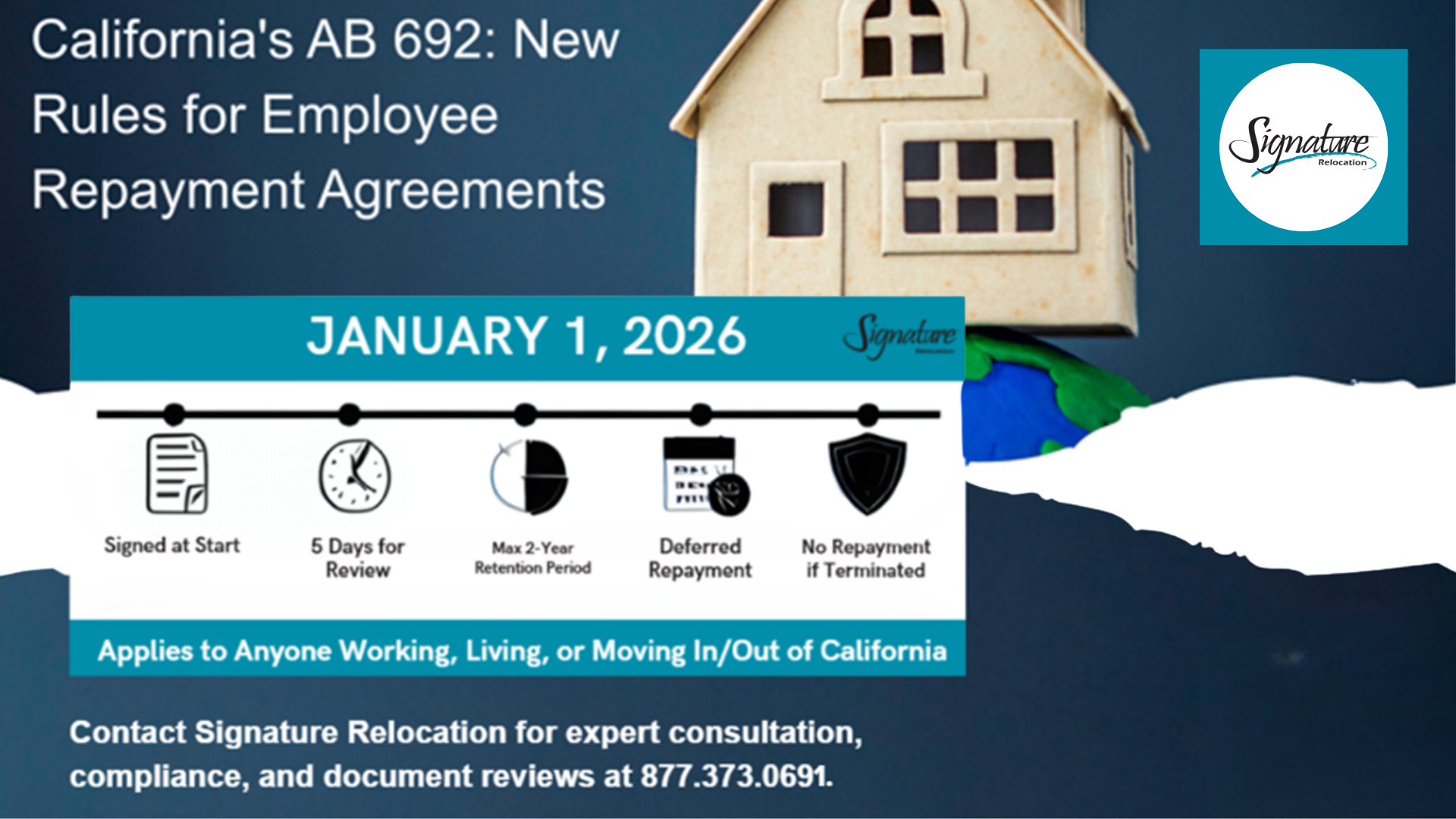

California AB 692 introduces new legal requirements for any employment agreement that includes repayment of relocation, immigration, or bonus-related expenses. Effective January 1, 2026, the law impacts employers with California-based employees, remote workers connected to California, and companies relocating talent into or out of the state. This guide outlines what has changed, who is impacted, and how HR and mobility programs should prepare.

Download to Learn:

Which employees and employers are covered under AB 692, including remote and relocating workers

The six legal requirements that must be met for any repayment agreement to be enforceable

How proration, deferred repayment, and termination rules affect relocation and bonus programs

What contract language and policy templates may need immediate review and updates

How AB 692 impacts relocation support, immigration sponsorship, and sign-on incentives

Practical compliance steps HR and mobility teams can take before the January 1, 2026, effective date

Complete the form for instant access to employer focused overview of AB 692 and its impact on relocation and repayment agreements.