Close Advanced Search Filters

Search

Companies

Content Types

Results > tax-planning: (11)

Advanced Search Filters

Clear Filters

Wednesday, December 10, 2025

FPA Live

FPA LIVE: What Planners Should Know About Charitable Giving in 2026

Tune in to this fun series of conversations with interesting people who are doing interesting things in and out of financial planning. Each interview is held live over FPA's social media channels and provided here to allow you to tune in whenever you want.

Tuesday, July 15, 2025

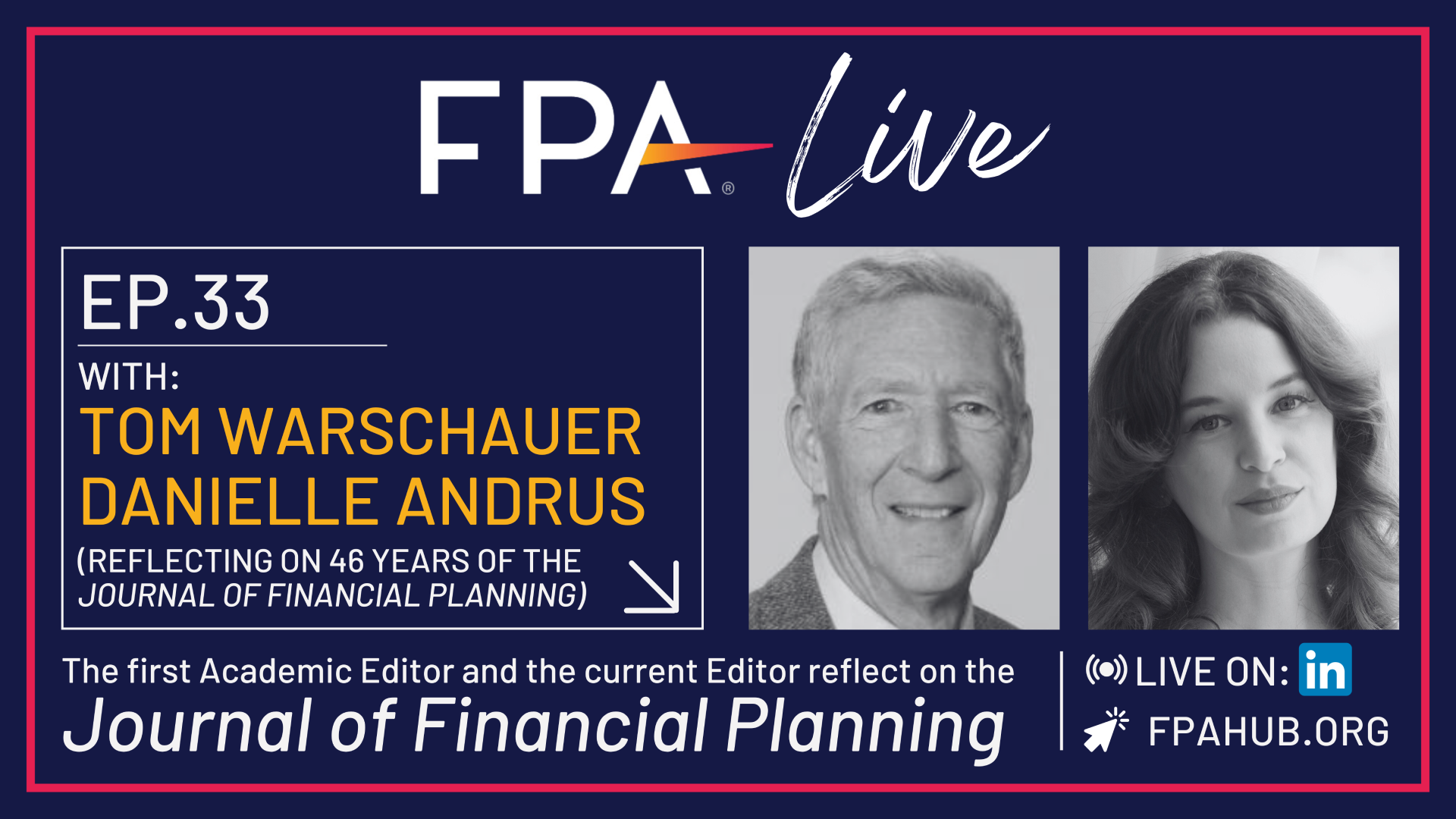

FPA Live

FPA LIVE: Celebrating the Legacy of the Journal of Financial Planning

Tune in to this fun series of conversations with interesting people who are doing interesting things in and out of financial planning. Each interview is held live over FPA's social media channels and provided here to allow you to tune in whenever you want.

Wednesday, May 28, 2025

Universal Financial Consultants

Why the “Big Beautiful Bill” Might Be a Big Mistake for Business Owners

Discover the Hidden Risks High-Net-Worth Clients Face

Thursday, May 8, 2025

Universal Financial Consultants

Tax Season Isn’t Over for Extended Filers—Here’s How to Maximize the Opportunity

Discover 5 High-Impact Strategies to Help Affluent Clients Reduce Tax Burden and Enhance Long-Term Planning

Tuesday, March 18, 2025

The Difference Card

A Guide to MERP Options and Their Tax Benefits and Advantages

Employers can enjoy significant tax advantages when they use a MERP to reduce healthcare benefits costs. Check out this Guide to learn more!

Tuesday, February 11, 2025

Universal Financial Consultants

How a Cash Balance Plan Helped a Business Owner Save $275K in Taxes

If you work with high-income business owners looking to reduce taxes and accelerate retirement savings, this case study is a must-read.

Friday, December 6, 2024

Commonwealth

4 Key Drivers to Launch Your Enterprise Transformation

Expanding your business requires more of everything—including assets, staff, and time—to meet your ambitious goals. Discover the four key drivers that turn advisory firms into thriving enterprises.

Thursday, March 14, 2024

Axos Advisor Services

Become a More Holistic Advisor

How to enhance client services and grow your business by adding integrated cash management solutions to serve both sides of the balance sheet.

Friday, October 13, 2023

Universal Financial Consultants

How to Defer Capital Gains Taxes and Have a Bank Pay Them Instead

Many successful individuals have assets that have appreciated significantly, and are looking for a structured approach to deferring capital gains taxes.

Wednesday, February 22, 2023

Commonwealth

The Ultimate Retirement Income Planning Guide for Advisors

Our free download helps you prepare your clients for the next phase of their life.

Wednesday, December 21, 2022

Universal Financial Consultants